Pitfalls in the Entrance & Exit of Foreign Investment

2019-03-29

2019-03-29

1931次浏览

分享到:

1931次浏览

分享到:

On March 15, 2019, the National People’s Congress of the PRC approved the Foreign Investment Law of the PRC, which will come into force on January 1, 2020 (“Effective Date”). Upon the Effective Date, the existing Law on Sino-Foreign Equity Joint Ventures, Law on Sino-Foreign Contractual Joint Ventures, and Law on Wholly Foreign Owned Enterprises, which are now still governing the foreign investment, will be simultaneously repealed.

The Foreign Investment Law has sketched out a holistic roadmap for foreign investors to make investment in China. However, a mere roadmap in hand is far not sufficient to ensure a smooth journey. Every step should also be watched, as the journey is full of pitfalls, big or small.

This article aims to identify those pitfalls in foreign investment that are easily overlooked.

Part I: Investment Policies & Procedures

1

Market Access & Negative Lists

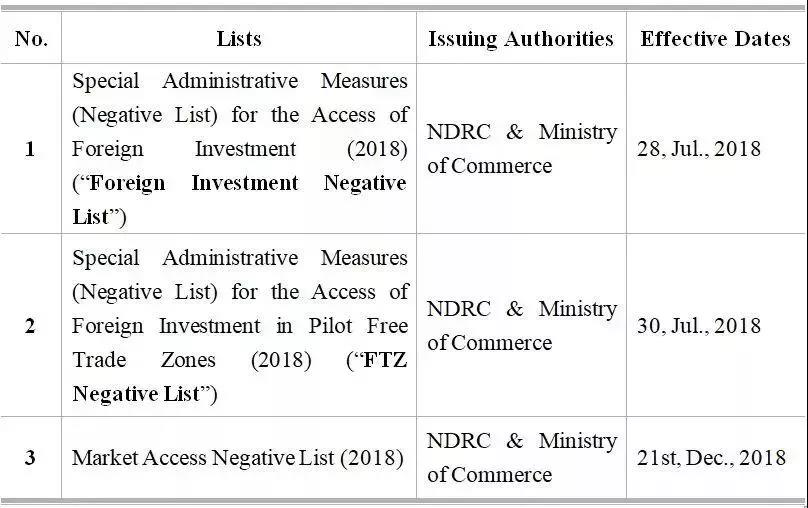

In 2018, China has ushered into the era of negative lists in terms of foreign and domestic investment administration. There are three main negative lists applicable to the foreign investment, as follows:

Pitfall: When you peruse the Foreign Investment Negative List, you will find such “sensitive” industries as culture and finance are not included in the List! Are they now totally open to foreign investors, free of any limitations or qualifications?

Of course, not. It should be noted that the Foreign Investment Negative List merely incorporates those “negative”* industries specifically applicable to the foreign investors, without including any “negative” industry universal to all investors, both domestic and foreign.

It is Market Access Negative List (2018) that specifies out the “negative” industries universal to all investors, both domestic and foreign.

Therefore, it follows that the foreign investment is normally subject to both Foreign Investment Negative List and Market Access Negative List.

If the investment is made in Free Trade Zones and if the Free Trade Zones have more favored or relaxing treatment, FTZ Negative List will prevail. The same goes for the inter-regional or inter-state arrangements or treaties as well.

*“negative” herein refers to being: i) prohibited and/or ii) if not prohibited, but subject to license or approval.

2

Simplified Procedures-- Filing System (Other Than Approval)

A foreign investor can establish a foreign-invested enterprise (“FIE”) or process FIE’s modifications through online filing system, provided that such establishment or modifications do not involve any industry outlined in the above negative lists. In this regard, no prior approvals from government authorities are required.

Pitfall: However, there is no rule without exception. In some special case, even if no industry in the negative lists is involved, the mere filing is not sufficient and approvals from government authorities are required as well.

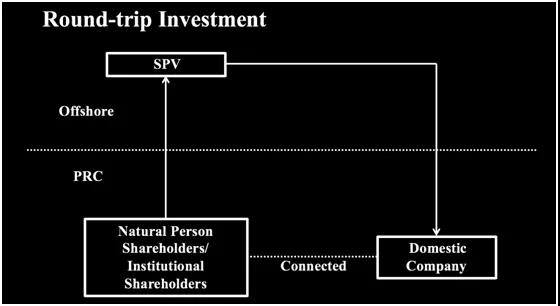

Pursuant to Regulation on the Acquisitions of Domestic Enterprises by Foreign Investors (《关于外国投资者并购境内企业的规定》) (‘‘M&A Rules’’), where a PRC company, enterprise or individual intends to take over its or his or her related domestic company in the name of an offshore company which such PRC company or individual lawfully established or controls, the takeover shall be subject to the approval of the Ministry of Commerce of the PRC (MOFOM, rather than the local branches of the Ministry of Commerce). Such cross-border related takeover is also called “Round-trip Investment”.

However, since September 8, 2006, the effective date of the M&A Rules, few approvals in respect of the above Round-trip Investment are successfully granted by the Ministry of Commerce.

3

How to Invest into the Negative Lists

Forbidden fruits are always the sweetest. The negative lists include such industries as TMT, internet and related services, education, medicare, and film production and distribution. Look! These industries are the prairies for “unicorns”.

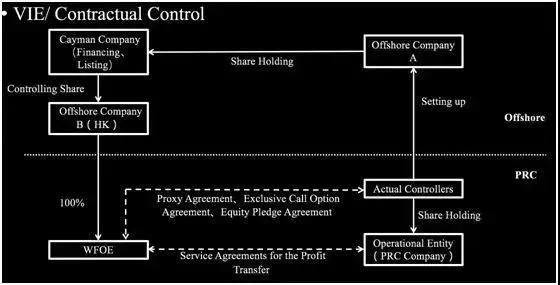

As there are shareholding limitations or prohibitions on part of foreign investors, VIE (Variable Interest Entity) structure or contractual control arrangements are accordingly adopted to overcome such shortcomings.

Pitfall: However, VIE structure is no panacea. On November 7, 2018, the CPC Central Committee and State Council issued Opinions on Furthering Reform and Regulating Development of Pre-school Education (《中共中央 国务院关于学前教育深化改革规范发展的若干意见》) (“Opinions”). The Opinions clearly states that the social capital shall not merge and acquire the non-profit kindergartens or the kindergartens sponsored by state or collective-owned assets, by means of VIE or contractual control agreements. The private kindergartens, in part or in whole, shall not be incorporated into the listed companies. And the listed companies are also not allowed to use its proceeds from listing to invest in for-profit kindergartens.

Part II: Entry of Foreign Investors

There are two mainstream ways for foreign investors to enter into China’s market: FDI and M&A. Unless otherwise stated, this part of journey is specifically called “Sieve Blvd”, as it is full of pitfalls.

1

Foreign Direct Investment (“FDI”)

As to FDI, there are some easily overlooked pitfalls, such as:

<1> Business Scope

A. Having witnessed too many P2P shams or PE frauds, many local Administrations of Industry and Commerce (“AICs”) are taking a prudent and unwilling attitude towards the application for incorporating “investment” into a company’s business scope.

B. If a foreign investor intends to establish a company with “investment” in its business scope, the AICs would more often than not recommend the type of foreign invested investment company(“FIIC”). However, the threshold for establishing FIIC is far higher than that of FIE. In case of FIIC, the foreign investor is required to have more than US $ 400 millions in its total assets one year prior to its application and to have already established FIE(s) in China with actual paid-up capital of no less than US $ 10 millions. Or alternatively, the investor is required to have already established over 10 FIEs in China with actual paid-up capital of no less than US $ 30 millions.

C. In the meanwhile, as required by the current foreign exchange policies, FIE’ registered capital can only be settled and used within the business scope and the bank will review the relevant supporting documents before transferring the money to designated account.

D. Therefore, if an FIE (other than FIIC) intends to purchase shares or subscribe registered capital of other companies or lend money to others, it is strongly advised to check with its account bank whether its capital can be settled and/or paid out in this regard.

<2>Total Investment and Registered Capital

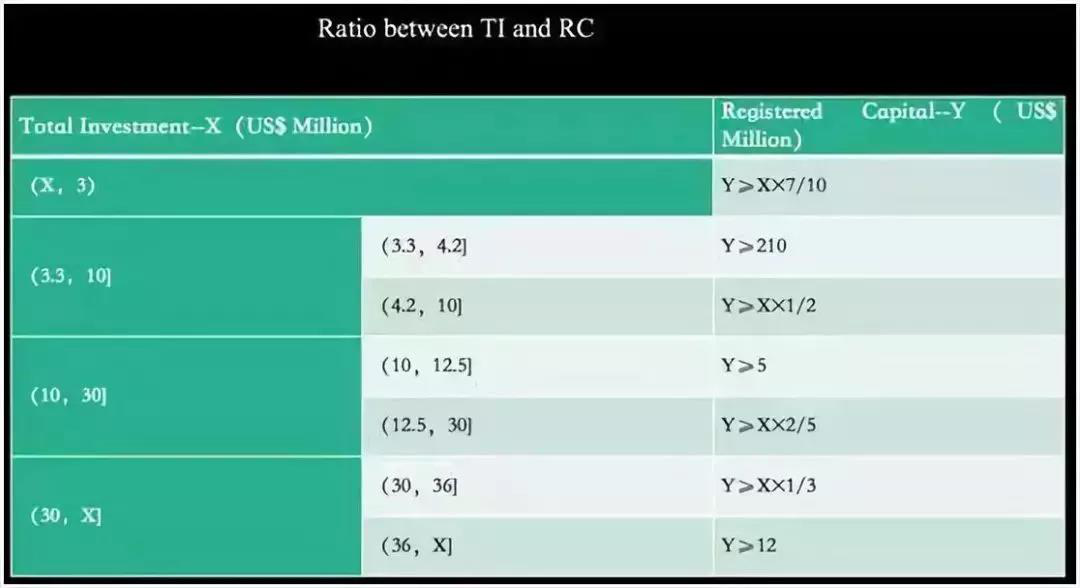

A. According to the current regulations, the registered capital shall be no less than certain proportion of the total investment:

B. In accordance with Notice of the People’s Bank of China on Full-coverage Macro-prudent Management of Cross-border Financing 2017 ( 《中国人民银行关于全口径跨境融资宏观审慎管理有关事宜的通知》(银发[2017]9号)), the FIE can borrow overseas debt within the difference between the total investment and the registered capital, or within twice the net assets of FIE.

<3> JV’s Shareholder Qualifications

According to the current laws, the Chinese individual is not allowed to set up a joint venture enterprise (“JV”) with the foreign investor(s).

Such situation is unlikely to change even after the Foreign Investment Law officially comes into effect, as PRC Constitution (Rev. 2018) provides that foreign investors are allowed to enter into various kinds of economic cooperation with PRC enterprise or other economic organizations. The Chinese individual is not mentioned there.

However, under M&A Rules, if foreign investors acquire some portions of shares of a domestic company and thus turn the company into a JV, the remaining Chinese individual shareholders are allowed to stay as shareholders.

<4> Veil Piercing-- Company with Sole Shareholder

According to PRC Company Law, if the sole shareholder fails to distinguish its personal property from the company property, the sole shareholder will be held jointly liable for the company’s debt.

Therefore, it is highly advised the FIE with a sole shareholder should maintain good accounting books and conduct regular audits, in particular when China is now adopting the far-reaching “credit blacklist” system.

<5> Land in Industry Park

The local governments encourage and facilitate the foreign investors to set up manufacturing factories (which will boost local employment rate), so they provide the foreign investors with lands at obviously favored prices. However, the lands shall be specifically used for building factories and ancillary supporting facilities. If you intend to develop real estate, such kind of land may not fit your needs.

Take Beijing for instance. Beijing Municipal Government has promulgated a series of policies to regulate the use of lands in industry parks. The real estate developed on these lands shall only be rented to the companies located in the parks. Selling or transferring the developed real estate to the companies outside the parks is forbidden.

2

M&A

As to M&A, there are some easily overlooked pitfalls as well, such as:

<1> To invest in Domestic Non-public Companies

A. The M&A agreements, including but not limited to SPA and capital increase agreement, shall apply PRC laws and be subject to approval of the Ministry of Commerce or its local branches (as the case may be);

B. As indicated in the M&A Rules, the consideration for M&A transaction (“Price”) shall be determined on the basis of fair appraisal rather than on random basis.

C. M&A Rules also sets out the time schedule of paying the Price. Though the Price can be paid in installments, the taxes relating to the transaction must be cleared once for all prior to any official registration by MOFOM or AIC. For instance, as provided in Article 15 of PRC Individual Income Tax Law (Rev.2018), when any modification relating to the equity transfer by an individual is to be registered, the AIC will review the certificate of tax for such equity transfer.

D. If the foreign investors merges and/or acquires a domestic company and thus turns it into an FIE, all of the Price shall be paid within 3 months from the date of granting FIE business license. If longer time is needed, the prior approval from MOFOM shall be obtained and no less than 60% of the Price shall be paid within 6 months from the date of granting FIE business license and the rest within 1 year. Before all of the Price is paid, the profits will be distributed in proportion to the price actually paid.

E. The Price shall be paid into an account specifically opened for the M&A transaction. If the foreign buyer pays the Price in foreign currency, the domestic seller shall open an onshore Asset Realization Account; if the foreign buyer pays the Price in Renminbi, the domestic seller shall open a specific M&A Account.

F. There is nothing in PRC laws that prohibits foreign investors from acquiring shares or equity of a domestic company with their shares or equity interest of an overseas listed company or SPV as consideration. However, such share swap is not common for the time being due to ODI and foreign exchange control policies.

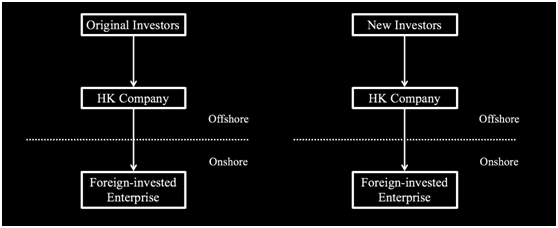

<2> Round-trip Investment

As mentioned above, under M&A Rules, where a PRC company, enterprise or individual intends to take over its or his or her related domestic company in the name of an offshore company which such PRC company or individual lawfully established or controls, the takeover shall be subject to the approval of the Ministry of Commerce of the PRC. It should be noted that since 8 September 2006, effective date of the M&A Rules, few approvals in respect of the above related takeover are successfully granted by the Ministry of Commerce (rather than the local branches of the Ministry of Commerce). In the context of Foreign investment Law, such provisions are unlikely to change, as they are still acting as one of the vital valves to control massive cross-border movement of assets.

Therefore, when an offshore buyer purchases the share or equity interest of a domestic company, it is strongly advised to check: 1) the identity of the ultimate beneficiary of the offshore company; and 2) whether the buyer and seller are related entities.

<3> To Invest in Domestic Public Companies

A. Non-strategic investment: The following foreign individuals are allowed to open onshore A-shares securities accounts: 1) foreign individuals working in the Chinese mainland, and 2) foreign employees of A-share listed companies who work overseas while participating in equity incentive plans offered by their employers.

B. Strategic investment: According to Administrative Measures of Foreign Investors Making Strategic Investment (Rev. 2015), if a foreign investor intends to make strategic investment into a listed company in China, it shall own assets of no less than US$ 100 million or have assets under management of no less than US$ 500 million. What’s more, the initial investment shall be no less than 10% of the issued shares of the listed company and the lock-up period is three years. On July 30, 2018, draft of the amended Administrative Measures of Foreign Investors Making Strategic Investment was published for consultation and many requirements therein are relatively relaxing. However, the draft has not been finalized yet.

C. Percentage required for filing: Only if the foreign investor’s shareholding percentage in a listed A-shares company or NEEQ-listed company has changed by 5% in aggregate, or if foreign investor’s controlling or relatively controlling status has been altered, these listed companies can then initiate the respective filing procedures.

3

FIE’s Further Investment

A. If an FIE makes further investment to set up an enterprise “B” in China, then whether B is an FIE or a domestic company in law? Actually, it depends on the industry in which B is engaged. If B’s industry imposes restrictions on the foreign investors, B is deemed an FIE; if B’s industry allows or encourages the foreign investors to make investment, B is a domestic company. However, it should be noted that FIIC per se is deemed as a foreign investor, so B invested by FIIC will be considered as an FIE.

B. If an FIE uses its distributed profits to make further investment in non-forbidden industries, no withholding income tax will be paid for the time being, as allowed by recent tax policies.

C. If an FIE use its shares or equity interest to invest, such shares or equity interest shall go through appraisal so as to determine their value. If their appraised value is larger than their book value, income taxes will be paid on the basis of that value differences.

Part III: Exit of Foreign Investors

Any legitimate proceeds, profits, or gains can be freely remitted out of China only after having been taxed in accordance with the PRC tax laws. As Albert Einstein said, the hardest thing in the world to understand is the income tax. Who can deny it?

1

Foreign Entity Investors Sell the Shares of FIE Directly

In the case of foreign entity investors selling shares of an FIE, the buyer has the duty of withholding and paying the taxes arising from the transaction to China’s tax authorities on behalf of the seller, though it is the seller that is the taxpayer under the tax laws. Where there is a duty, there is a punishment, if the duty is not fulfilled. We will discuss it in the following section.

The tax will be calculated on the basis of the difference between the selling price and the price paid by the seller to initially obtain the shares in question. The tax rate thereof is normally 10%. Of course, there are inter-regional, bilateral, or multilateral arrangements or treaties in terms of avoidance of double taxation or exemption, which shall prevail.

As provided in Arrangement between the Mainland of China and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income, if the company chiefly comprises of immovable property in the Mainland, then the gains from selling shares of the company would be taxed in the Mainland. If the portion of alienation of shares is not less than 25% of the entire shareholdings of the company which is a resident of the Mainland, then the gains derived from the alienation may be taxed in the Mainland. If the above portion of alienation of shares is less than 25%, the gains may be exempted from being taxed in the Mainland.

2

Foreign Entity Investors Sell the Shares of FIE Indirectly

If the foreign investors sell the shares of an oversea company which is directly or indirectly holding the shares of an FIE, even if the transaction occurs overseas and payment is made outside China, the buyer still has the duty of withholding and paying the taxes arising from the transaction to China’s tax authorities on behalf of the seller.

If the buyer fails to withhold or deduct the taxes, it is likely to be subject to a fine ranging from 50% to 300% of the taxes that should have been withheld or deducted by the buyer.

If the seller refuses to have the taxes withheld or deducted, the buyer is obliged to report the situation to the tax authorities. Then the tax authorities will pursue the seller.

If the seller still fails to pay the taxes within the time period specified by the tax authority, the tax authority will enforce such liabilities against the seller. Besides the taxes payable, a fine ranging from 50% to 500% of the taxes payable will be imposed and collected.

When the tax authorities enforce the tax liabilities against the seller, they can collect and investigate into any information relating to seller’s other projects or transactions located or occurred in China. If there is any outstanding payment to the seller in these other projects or transactions, the tax authorities are entitled to give a notice to the payers, demanding them to deduct and pay directly to tax authorities the amount equal to the taxes and fines that the seller has failed to pay.

3

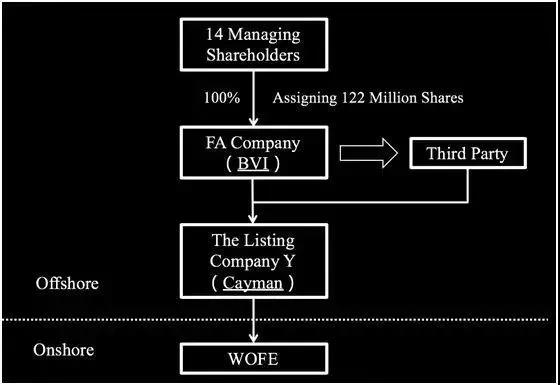

Foreign Individual Investors Sell the Shares of FIE Directly or Indirectly

A resident individual is defined as an individual who has domicile within the territory of China or who has no domicile but has resided in the territory of China for a cumulative period of 183 days within a tax year. He or she will pay individual income taxes for their global income and the tax rate for the income deriving from share transfer is 20%.

The 14 Chinese shareholders in the above chart was demanded by China tax authorities to pay RMB 250,000,000 as income taxes payable.

The non-resident individual is defined as an individual who has neither domicile nor residence in China, or who has no domicile and has resided in China for a cumulative period of less than 183 days within a tax year. He or she shall pay individual income tax for the income deriving from selling the shares of FIE directly or indirectly, no matter where the payment is made, offshore or onshore. The tax rate thereof is 20%.

Conclusion

For foreign investment, every penny counts and every detail matters. So, it is strongly advised that foreign investors should keep a close eye on further development in respect of the details or pitfalls mentioned in this article, in particular, in the context of the upcoming Foreign Investment Law. Bon Voyage!

返回列表

返回列表